While, it could be argued, that poor children were the big winners from Budget 2018, rural communities may benefit too. Broader tax cuts may not have featured as the Government balanced its books but some in the horse breeding business can bet on paying less.

While, it could be argued, that poor children were the big winners from Budget 2018, rural communities may benefit too. Broader tax cuts may not have featured as the Government balanced its books but some in the horse breeding business can bet on paying less.

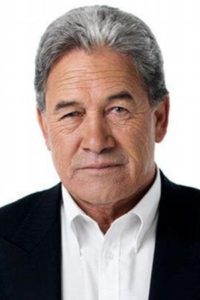

“The Budget allows $4.8 million over the next four years for tax deductions that can be claimed for the costs of high-quality horses acquired with the intention to breed,” Winston Peters (Minister for Racing) says. “Racing is a significant industry in New Zealand and this measure will provide economic stimulus to many parts of the country.”

The tax changes, which the Deputy PM expects to be in place in time for the next National Yearling Sales in Karaka, are set to benefit new investors.

“A new investor in the breeding industry will be able to claim tax deductions for the costs of a horse as if they had an existing breeding business. To qualify, the horse must be a standout yearling,” he explains.

“Quality breeding is the life blood of the thoroughbred racing code. It also helps sustain an iconic industry and ensures New Zealand horses can compete with the best in the world.”